How Much Should I Save for Retirement?

Save for Retirement - How Much do I need to Retire?

Most Americans forgot how to save as early as 1982, as the savings rate fell from 12% of disposable income to almost zero.

While many say that retirement is a concern, remarkably few have bothered to work out how much money they may need to maintain their lifestyle on retirement nor, how much they have to save to reach it.

The sage advice from our parents still applies. Save first, place funds into 401k, IRA or a brokerage account before it reaches your pocket. You are in charge of whether you will sink or swim on your retirement date.

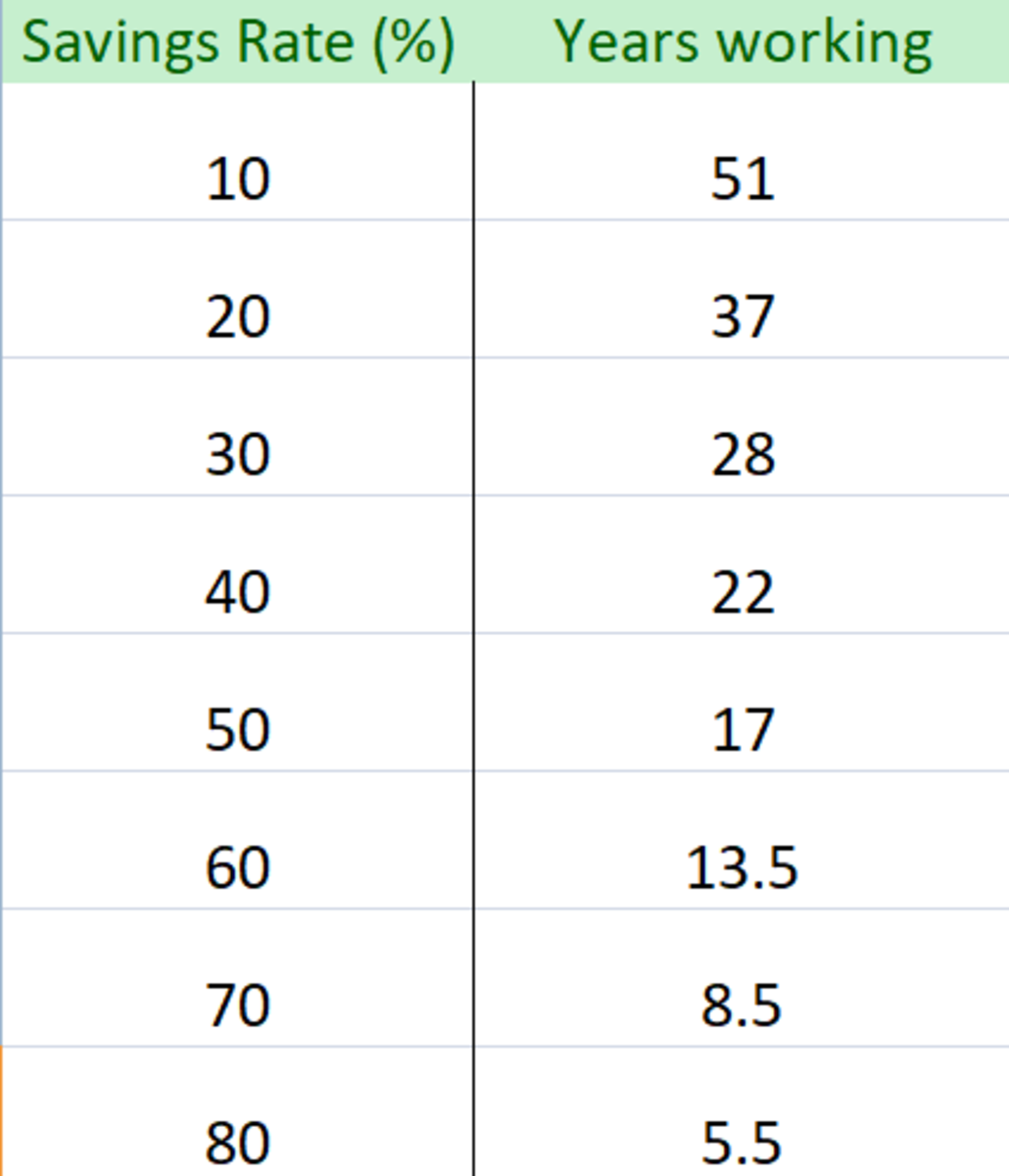

Obviously this issue may only be answered once your age and earning capacity is factored in to the equation. Generally, the following applies:

Max out your 401(k) and after that a IRA account, in order that your savings are taking full advantage of the tax benefits being offered by the government. Only after you have reached the maximum in both accounts should you save outside of these accounts, for your retirement.

RETIREMENT SAVING - Work Out How much you Need

To produce an average monetary figure of where you should be, the following will apply:

- To retire at 65 on 80% of salary, you would need to have 2.5 times your salary already saved by the age 40.

- Then 12% per year until the age 45 and then increase it to 15%.

- This assumes that there will be a 4.5% above inflation, real rate of return, annually.

You could take as a general rule of thumb, that if you start saving 15% of your salary from the day you start work, you should theoretically be comfortable retiring at 65, providing your home is mortgage free.

That 15% is obviously divided up between your 401k, IRA and the balance into an investment account.

You will also have to keep checking every year to ensure you are keeping on track.

Dave Ramsey: Stop Committing Financial Suicide - Retirement

HOW MUCH MONEY DO I NEED TO RETIRE, IF I START IN MY 20'S

Paying the maximum amount in to your 401(k) must be a given. The difference of what you are paying on your 401k and the 15% you need to save should then go into an IRA.

The tax advantages, on these two forms of retirement savings, will be enormous by the time you reach retirement age. If your salary warrants it, put the outstanding balance of the 15% into an investment account, such as a low-fee mutual fund.

HOW MUCH MONEY DO I NEED TO RETIRE, IF I START IN MY 30'S

According the Federal Reserve's survey, most people in their 30's are in debt and carry the largest debt burden, relative to their earnings.

⁃ This is due to the majority of people buying their own homes and having children at home.

⁃ Credit card debt is high, with a large percentage of people not paying the card off in full each month.

⁃ One out of four 30 somethings still owe money for student loans.

⁃ Ensure you are taking full advantage of 401k or 403b plan your company may offer.

You should be putting in around 20% of your disposable income in retirement funding, split between 403k, IRA and private fund.

HOW MUCH MONEY DO I NEED TO RETIRE, IF I START IN MY 40'S

You now have less time to recover from financial mistakes. Your income is higher, but you are handling hefty expenses such as home mortgages, children's education and paying down car and credit card debt. You need to build wealth and control debt.

According to the Federal Reserve's Survey, 60.7% of people in their 40's have workplace retirement or private retirement plans in place, compared to 54% of people in their 30's.

As these figures are a long way from ideal, you need to focus on paying attention to your cost of living and if necessary introducing cut backs. Every $1.00 you fail to save now will cost your $10.00 less in retirement income.

College Strategies: Naturally you want to give your children a decent start, but don't undercut your own future. Do not take on more debt than you can repay, and consider the lower cost alternatives if it means cutting your own retirement savings.

Review your insurance including both life and disability cover.

Retirement Planning Mistakes

HOW MUCH MONEY DO I NEED TO RETIRE, IF I START IN MY 50'S

Although people in their 50's are at their peak earning power, they may not have children at home, but they are still paying off debt.

Steep losses in retirement funds and home equity in recent years will have those nearing retirement worried about their future.

Many things can seriously affect finances, such as illness, layoffs, disability. Poor insurance protection, poor planning and children returning home due to their job loss, is a a serious hindrance.

You may not be able to reconsider a new career at this stage, but talk to a career counsellor if your industry is downsizing e.g. retailers, magazines or newspapers.

You will not be able to recoup your costs of returning to anything other than a night school, and that is only if you can pay it out of your current income.

If you want to start your own business, do it as a sideline first to see if it is feasible. Remembering that around 70% of new businesses fail within 3 years.

If you still have minor children to raise, as 45% of households do in this bracket, or perhaps your parents need assistance, you will need to re balance your retirement accounts so that you are not taking too much or too little risk.

If you think about retiring before 65 years, you will need to consider the following:

• What health insurance options are available to you. E.g. Does your company have retiree medical coverage or are you eligible for COBRA continuation coverage.

• Will you sell your home and move, is downsizing an option?

• What about long-term care coverage or will you need to set funds aside to cover this?

• Debts must be sorted out, credit card debt must be the first to go, while paying off the mortgage will give you so more fun money.

• Insure your life insurance needs are adequately covered.

• Schedule a full medical check up every year. As you age, the risk for serious health conditions rises and you don't want to wait and then be told it's too late.

• Join AARP for many discounts. Membership in 2012 is only $16.00 per annum.

10 Steps to Take - When you are in your 60's

If you have a choice, this is now your last chance before you leave your job.

The Stock market crash of 2008 did massive damage to the retirement nest egg, and many people in their 60's are carrying large debt.

1. Decide on an actual Retirement date because your funds are dependent on this, although you will have to be flexible if it turns out to be too early.

2. Decide where you are going to live e.g. stay where you are, downsize, move to a retirement village.

3. Include medical costs, health insurance is expensive before age 65. Medicare will not alleviate your problems to any great extent as relatively healthy couples can spend $1000 or more per month.

4. Deal with Debt - pay off if at all possible before your retire. If you cannot, contact a legitimate credit counselor or bankruptcy attorney to discuss your options.

5. Work out a budget that you believe will be usable when you retire and live on it for a few months to see if it is feasible.

6. Social Security can be taken from age 62, but the same as any pension your may have, the longer you wait the bigger your benefit check.

7. The majority of Financial Planners agree that you should not draw more than 4% of your retirement savings in the first year.

8. If you have a nest egg, perhaps you could consider an immediate annuity. This means that you would place a lump sum with an insurer, and they would pay you an annuity for life. If you take this route, make sure the insurer you choose has solid finances and low expenses.

9. Now that you have all the figures, see if your plan will work. Use a return rate of no more than 6%, which is a conservative rate for a portfolio of stocks, bonds and cash. Surprises must be on the upside. Run best and worst case scenarios using assumptions regarding inflation, rates of return and your life expectancy.

10. If you are short - work out where you will stand if you work longer, or move to a cheaper home. Ensure you obtain a second opinion from an experienced retirement planner.

Deal with your estate plans to ensure you have a durable power of attorney for finances and health care. Consider a living will for the end of life care. Review and update your wills or trusts.

© 2012 Shelley Watson